what is a deferred tax provision

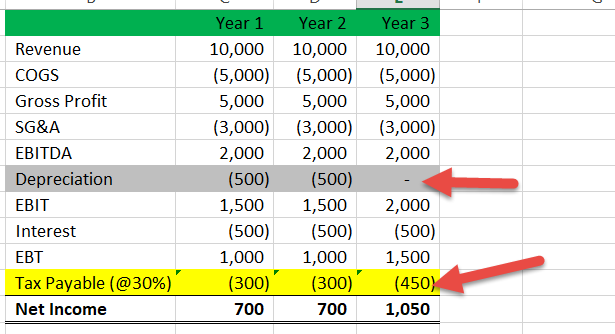

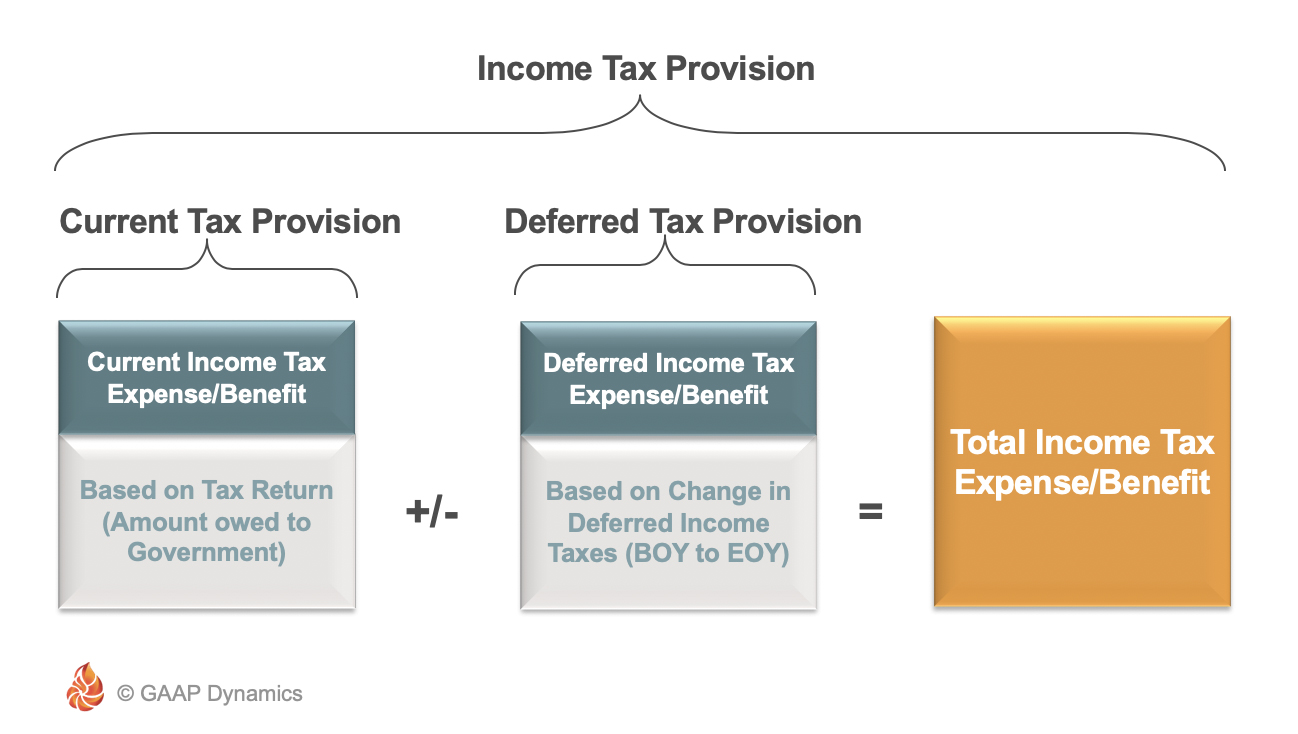

While Permanent differences are the ones between taxable income and accounting income for a period. Usually this results in no net change to the ASC 740 provision for income tax the change in the current tax provision offsets the change in.

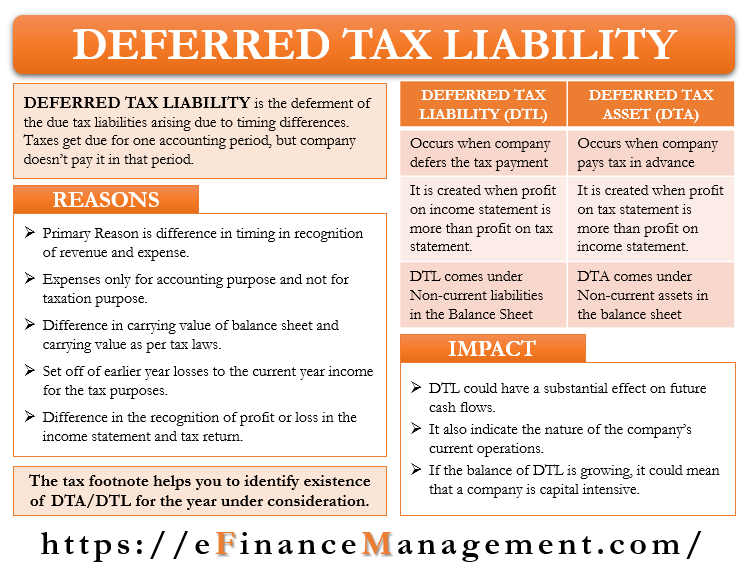

Deferred Tax Liabilities Meaning Example How To Calculate

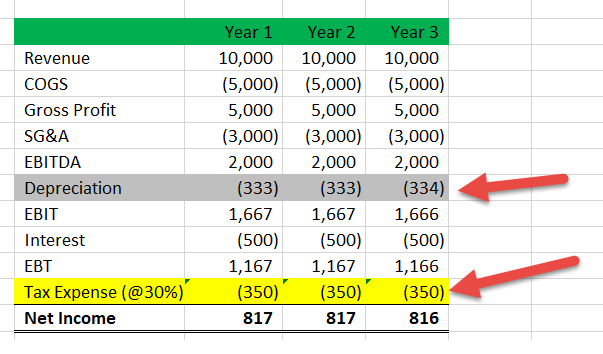

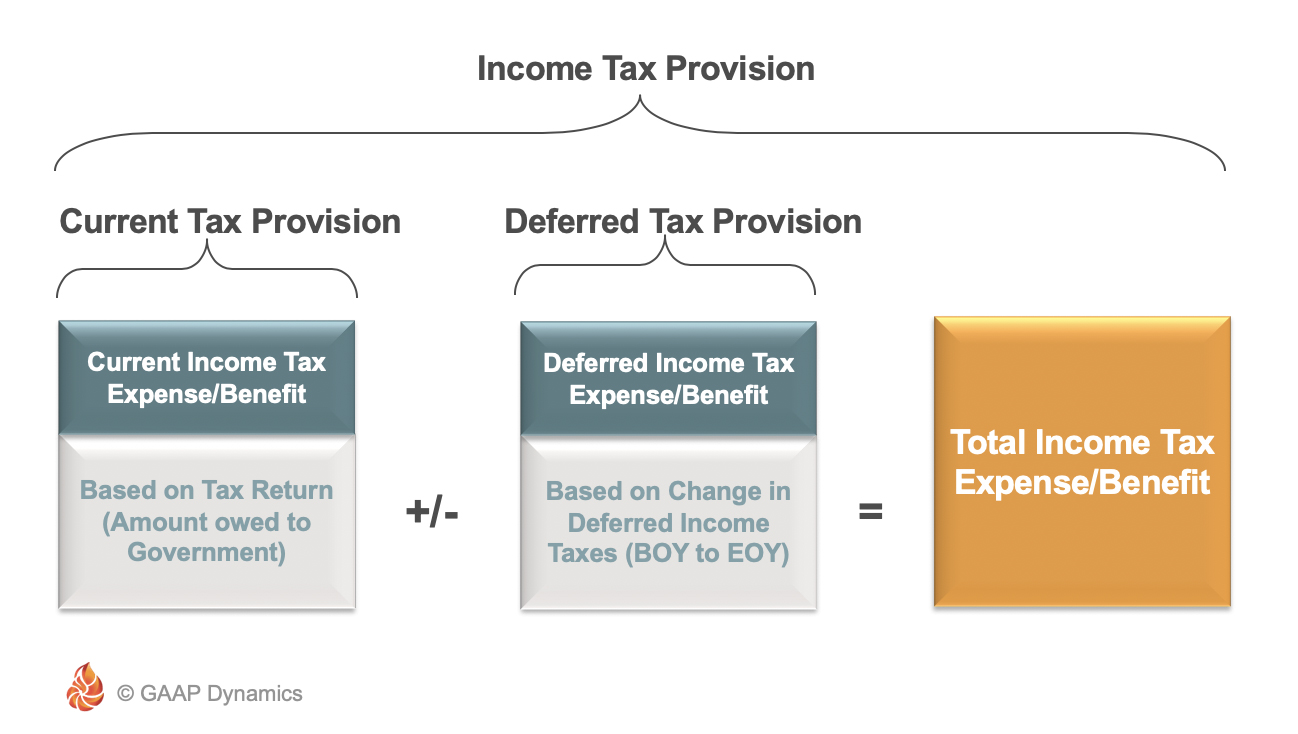

The result is your companys current year tax expense for the income tax provision.

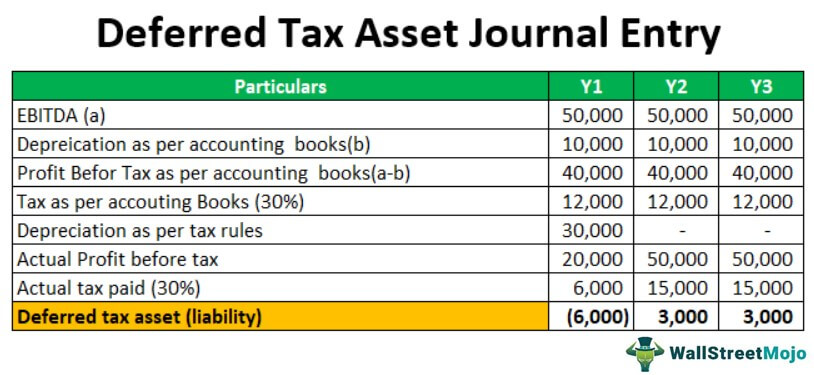

. Deferred tax is the tax effect that occurs due to the temporary differences either taxable temporary difference or deductible temporary difference. A provision is created when deferred tax is charged to the profit and loss account and this provision is reduced as the timing difference reduces. There are 2 types of timing differences viz.

Decrease the book profit by the amount of deferred tax if at all such an amount appears on the credit side of the profit and loss account. Carrying amount was R90 000 and the tax base was R0. Tax rate change complication.

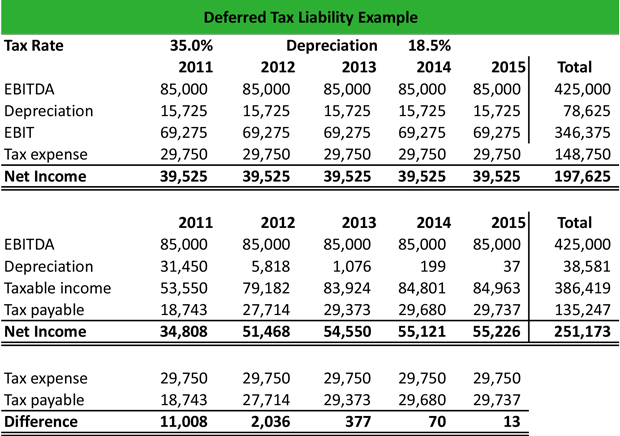

A deferred tax liability is a listing on a companys balance sheet that records taxes that are owed but are not due to be paid until a future date. Increase the book profit by the amount of deferred tax and its provision or. As per AS 22 Current tax is the amount of income tax determined to be payable recoverable in respect of the taxable income tax loss for a period.

This more complicated part of the income tax provision calculates a cumulative total of the temporary differences. Generally FRS 102 adopts a timing difference approach ie deferred tax is recognised when items of income and expenditure are. Deferred income tax expense.

Both will appear as entries on a balance sheet and represent the negative and positive amounts of tax owed. Deferred tax liabilities and deferred tax assets. In year 1 they buy a computer for 1800 and this is written off in the accounts by way of a.

Example 1deferred tax asset related to a provision Applying IAS 37 Provisions Contingent Liabilities and Contingent Assets a company recognises a provision of CU100 regarding a legal dispute2 The company receives a deduction for tax purposes only. C Deferred tax arises if at the end of the year the carrying amount it different from the tax base. A business has profits each year of 5000 before any depreciation charge.

Deferred tax expense or benefit generally represents the change in the sum of the deferred tax assets net of any valuation allowance and deferred tax liabilities during the year. The liability is created not due to Company defaulting on its tax liabilities but due to timing mismatch or accounting provisions Accounting Provisions The provision in accounting refers to an amount or obligation set aside by the business for present and future commitments. The liability is deferred due to a.

More specifically we focus on how government support in the form of tax incentives and tax relief might change previous assessments that were made applying IAS 12 Income Taxes IAS 12. The term deferred tax in essence refers to the tax which shall either be paid or has already been settled due to transient inconsistency between an organisations income statement and tax statement. For this reason the.

Answer 1 of 2. Deferred tax is the tax effect of timing differences. The company usually either has deferred tax liability or deferred tax asset as the deferred tax would be net off between deferred tax liability and deferred asset.

The deferred tax may be a liability or assets as the case may be. Lets look at an example. Deferred tax charge is not a provision for tax but is a provision for tax effect for difference between taxable income and accounting income and further that deferred tax charge cannot be termed as income-tax paid or payable which has to be paid out of the profit earned.

This article Deferred tax provisions 123 kb sets out four key areas of your tax provision that could be affected by the impacts of COVID-19. There will be an increase in the CT rate from 19 to 25 from 1 April 2023 where a company has profits in excess of 250000. The deferred income tax is a liability that the company has on its balance sheet but that is not due for payment yet.

This article will start by considering aspects of deferred tax that are relevant to Paper F7 before moving on to the more complicated situations that may be tested in Paper P2. Carrying amount was R150 000 and the tax base was R75 000 thus there would be deferred tax. Deferred tax is a topic that is consistently tested in Financial Reporting FR and is often tested in further detail in Strategic Business Reporting SBR.

Note that there can be one without the other - a company can have only deferred tax liability or deferred tax assets. This article will start by considering aspects of deferred tax that are relevant to FR before moving on to the more complicated situations that may be tested in SBR. Deferred tax can fall into one of two categories.

Deferred tax is a topic that is consistently tested in Paper F7 Financial Reporting and is often tested in further detail in Paper P2 Corporate Reporting. Companies first need to calculate their current income taxes payable or receivable then figure out their deferred tax assets and liabilities. Deferred tax liability is created when the Company underpays the tax which it will have to pay in the near future.

As per this definition there are two types of deferred tax-deferred tax asset and deferred tax liability. Temporary differences create deferred tax assets or liabilities because their reversal affects future tax expense. A deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the companys accounting methods.

A deferred tax of any type is. Deferred tax is the amount of tax payable or recoverable in future reporting periods as a result of transactions or events recognised in current or previous periods accounts. Income Tax Slab Tax Rates for FY 2020-21AY 2021-22 FY 2019-20 AY 2020-21.

Hi Deferred Tax refer to tax effect in your Balance sheet due to timing differences in recognizing income. The deferred tax provision is there to smooth the timing difference so in our example above the deferred tax provision would be 2850 22800 - 19950.

Deferred Tax Asset Journal Entry How To Recognize

What Is A Deferred Tax Liability Dtl Definition Meaning Example

Deferred Tax Liabilities Meaning Example Causes And More

Deferred Tax Liabilities Meaning Example How To Calculate

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)